Turks Grow Interest of Business in Greek Islands in Aegean Sea

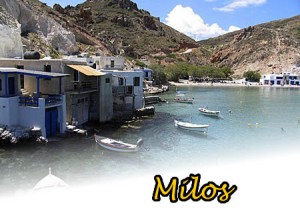

With news of Greece’s planned “fire sale” of a number of its islands in the Aegean Sea off of Turkey’s western coast started to appear in the media, Turkish entrepreneurs showed a keen interest in bringing certain business plans to fruition.

With news of Greece’s planned “fire sale” of a number of its islands in the Aegean Sea off of Turkey’s western coast started to appear in the media, Turkish entrepreneurs showed a keen interest in bringing certain business plans to fruition.

This interest recently produced more signs as the country’s northwestern neighbor accepted the establishment of an autonomous privatization agency that will coordinate the sale of many Greek assets, including the islands, to raise 50 billion euros in revenue to avoid a default that is seen as likely to occur.

Ekrem Demirtaş, chairman of the İzmir Chamber of Commerce (İZTO), who spoke to the Anatolia news agency, said: “We wish to make the best use of these islands located in the most beautiful part of the world. Why shouldn’t we create touristic neighborhoods on those islands with a joint Turkish-Greek investment?” Referring to a recent meeting he had with a Greek real estate group, Demirtaş added that he had asked them to show him one of those islands planned to be sold by the Greek government, but it was “too small” for what he had in mind. “Now there is another island we are talking about,” he said. He did not specify which group he’d been in touch with about his proposal.

Selim Egeli, head of the Turkey-Greece Business Council at the Foreign Economic Relations Board (DEİK), on Monday said that now is the best time for Turkish investors to invest in neighboring Greece to turn present risks in this debt-ridden European nation into an opportunity.

FİYAPI A.Ş. Board Chairman Fikret İnan, a leading construction firm, said on Tuesday that he plans to buy at least three Greek islands on each of which he intends to construct one luxurious hotel and dozens of villas. He said he has earmarked 20 million euros to purchase at least three of the six available islands of Lichnari, Kaltsonisi, Mikri Amorgos, Kardiotissa, Nausika and Vouvalo. He said another 80 million euros has been set aside for constructions he has planned.

A mid-size member of the 27-nation EU and the eurozone, which refers to the 17 EU nations that use the euro as their common currency, Greece is now facing a possible default on its huge debt, which is one-and-a-half times larger than its gross domestic product (GDP).

It was bailed out last year with a 110 billion euro ($159 billion) aid package from the EU and the IMF, but that package failed to put the debt-ridden nation back on track. Unable to return to international bond markets before 2012 to borrow at a cost cheaper than private lenders currently ask, the country, most observers believe, will need another voluminous bailout package to try once again to get back on its feet. The European Commission has said that Greece will need an extra 115 billion euros in aid through the middle of 2014, on top of the first bail-out package, although some of that financing will come from the private-sector contribution as well as planned privatizations.

The closeness of those islands to the Turkish mainland has in fact created a dispute between the two nations as to the extent of their territorial waters. The issue has not yet been resolved as Greece claims that its territorial waters should be extended from six to 12 nautical miles, citing an international maritime agreement, whereas Turkey, which is not a party to the agreement, disputes its northwestern neighbor’s claim. Since any Turkish takeover of a Greek island in the Aegean Sea is likely to be a highly contentious issue in mainland Greece, Turkish-Greek cooperation in conducting business activities on the islands seems to be a proposal less politically delicate.

For Demirtaş, İZTO is not following what may be referred to as an opportunist policy but rather aims to help Greece as it tries avoid defaulting on its massive debt. “In the latest visit we paid to Greece, we told them we could overcome this crisis together. We also told them let’s sit and talk about what we can do about it because we have great experience in [surmounting] crises. I believe they, too, will gradually recover,” he told Anatolia.

06 July 2011,

SOURCE: TODAY’S ZAMAN