Turkey Weekly Economic Outlook (Week 31/2012)

TURKEY WEEKLY ECONOMIC OUTLOOK

TURKEY WEEKLY ECONOMIC OUTLOOK

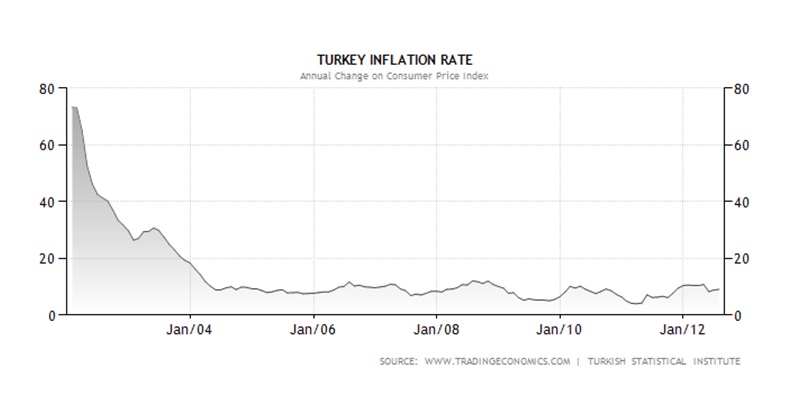

Considering the data about Turkey, the release of inflation and current account data was of great interest. We observe that there is a decline in current account deficit and in inflation rate in parallel with expectations of Central Bank of Turkey.

In fact, contractionary economy policy and efforts made to balance high growth rates have still contributed to these two downward movements. At the same time, growth rate of this year is also expected to be lower than previous growth rates.

However,Turkish economy is also expected to achieve sustainable growth.According to the projections of OECD ,Turkey is going to be the fastest -growing economy among OECD members with the average growth rate %6.7 for 2011-2017.

If we add to some notes on expansionary monetary policy, it would be wise to consider a vicious circle: As all we know,new financial structure enables capital movements to flow globally,in other words ,it provides capital with free-circulation.Then we ask why expansionary monetary policies adopted by the U.S and Europe,whic h have been experiencing low growth rate problem, haven’t generated remarkable results.

The answer underlies the fact that interest rates are higher in emerging countries compared to the interest rates in developed countries .Thus,the excess money created by FED and European Central Bank doesn’t stay in domestic area and it is going to flow into countries with higher interest rates. Accordingly, the expansionary monetary policy doesn’t stimulate economic activity domestically due to the discrepancy in interest rates on world-wide. European Union ‘ experience is a good example to us: Having bond purchase at the total value of 1 trillion did not create any remarkable economic activity in the Eurozone. On the contrary, the economies continued to contract.

Money Market Developments and Expectations

Usd-TRY

While viewing intensive economic data releases, the possibility of expansionary monetary policy measures and expressions , expectations of central banks,we observe that Euro has been taking breath for a while thanks to the soft approach of Merkel’ government. Furthermore, stock market has turned to ‘green ‘ and dolar index has been decreasing.

Aside from this,Turkey’s currency,TL ,has seemed to gain strength according to realizations of inflation rate and balance of trade , which have moved in parallel with the expectations.

Accordingly, dolar\tl parity,which has currently declined to 1,77 from 1,82, could keep declining up to 1.75, as long as the parity doesn’t jump over 1.80 tecnically.

Next week, the parity will possibbly get stuck between the values of 1.77-1.79 . In case of exceeding these values, upward movements would accelerate. In the state of the values below 1.77,the parity would decline up to the value of 1.75. In the state of the values above 1.79 ,the parity would increased up to the value of 1.81.

Euro-TRY

Euro has found support on global markets thanks to soft speech\ approach of Merkel’ governments and to some good data coming from the U.S. However, Euro has maintained its horizontal movement against TL. Euro\TL parity ,which has not been much volatile, seems to maintain its importance on the interval of 2.20-2.24 . The values between 2.22-2.24 can be projected as critical.

According to our projection,we expect that in case of the values below 2.20,the parity would decline to 2.17-2.18.In case of exceeding the value of 2.24,the parity would rise up to the value of 2.24 at maximum.

Euro-USD

Euro/dollar parity experienced an immediate decline up to 2.22 and even up to 2.130 due to the fact that Super Mario Draghi’s press statement ,which was very ordinary and full of unfulfilling expressions with regards the expectations ,causing an excessive sales. Hence the parity declined to up to value 2.130. However,the parity moved upward immediately and reached again the values above 2.13 owing to the good athmosphere following the previous bad weather.

In times of releases of intensive economic data and central bank monetary policy committe meetings, we have seen such immediate and excessive movements for 2-3 years .This great volatility causes many to loose whereas it provides many to make huge profits.Another contribution stems from leveraged transactions. If we consider the global crisis and developments in international capital movements in this perspective,interpretations will be different.

To sum up, the value of 1.2440 is critical.In case of exceeding 1.2440,the parity would increase to 2.27.In turn,this causes Dollar/TL parity to decline up to the value of 1.75 and even to lower values. This is why changes in Euro\Dollar parity important to us. 2.2320 could be the primary supportive value. Below this value,an upward trend in the parity could replace itself with sales.

Yasin BALCI

Financial Market Analyst

twitter.com/yasin_balci

Mr. Yasin BALCI is going to write brief reports about finance markets in Turkey, on businessturkeytoday.com. Today, we are publishing his first report and we believe and hope our visitors will benefit from his findings in this regard

WHO IS Yasin BALCI

Mr. BALCI graduated from Gazi University Econometrics in 2009. After the graduation he worked in different brokerage companies as “money market analyst”. Cureently, he is a financial specialist at a private company and also doing master degree in Finance at Istanbul University. He is a consultant for Forex markets analysis methods.